Managing Your Finance With Bullet Journal

Whether it’s achieving your financial goal like going debt free, saving for a house, or planning for early retirement or solely just wanting to manage your money, we’re here to show you how we do it.

Expenses Spread

The first step is, of course, to know how much you actually spend. For you analog fans out there, you can track all your daily expenses here by noting down the date, item, place, amount and payment like this. By the end of the month, you would’ve known how much you spend, on what, by card or cash.

Based on this, you can adjust your expenses accordingly or cut out unnecessary spending. If you want to save some time, you can also include another page on fixed expenses such as membership fees, subscription or bills.

Budgeting Spread

Now, after knowing your expenses and adjusting it, you can start on your budgeting spread and work towards your financial goals. The overview can be generally split into income, savings, debt and other. Then, you can write down how much you plan to allocate for each section and track the actual amount at the end of the month. You can further break down each section into a budget graph spread as we did so you can visualize the whole picture.

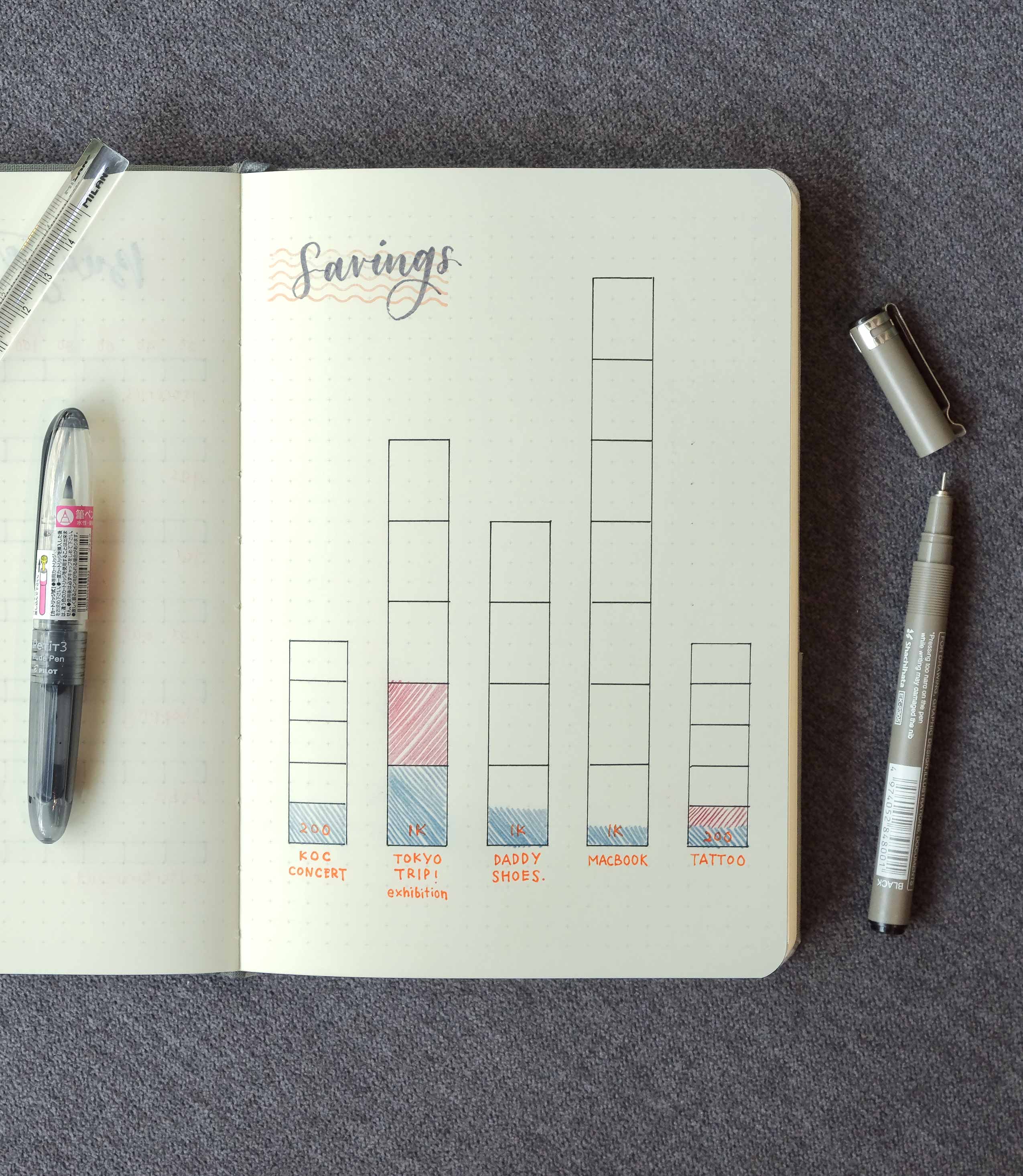

Savings Spread

Part of achieving your financial goal is savings. It could be for something big like an emergency fund or a downpayment for a car. Your guilty pleasure like a trip, a pair of your dream shoes or meeting your favourite bands will become less guilty too if you actually save for them instead of splurging.

On this spread, you can see how much you should actually save and how far is your progress. With each block shaded, you’re one step closer to it.

In conclusion, if you love using the analog method, here are some examples that we hope are useful for you. Feel free to customise them any way you want and show us how you do it by tagging us @summorieco or #summoriebujo. Don’t forget to drop on a comment to let us know what you want to see next!

1 comment

You should post this more often!